At the beginning of the year 2021, the legislative changes concerning the taxation at source came into force. To get a clearer picture, we propose to summarize the main changes that have occurred.

First of all, as of January 1, 2021, the canton of residence of the worker taxed at source is competent to collect the tax, which means that the employer (debtor of the taxable benefit) must register with the canton of residence of his employee and settle the tax at source directly with this Canton. For employees residing abroad, the competent canton for collecting the tax is the canton of the employer’s seat. Here are two examples, that illustrate this change:

- For an employee domiciled in the Canton of Vaud and working in Geneva, the Geneva employer must register with the tax at source department of the Canton of Vaud and deduct the tax according to the rate applicable in the canton of Vaud.

- For an employee domiciled in Annemasse, in France and working in a company with its headquarters in Geneva, the employer will have to deduct the withholding tax according to the rates applicable in the canton of Geneva.

Secondly, the employer has a broader reporting duty. Indeed, for a correct collection of the tax at source, he must establish in a precise manner the personal situation of the worker, in particular whether he or she is subject to tax at source, the marital status, the number of children, the confession (in some cantons), etc. It is the worker’s duty to inform the employer in a correct manner about all information that is decisive for the collection of the tax at source. If the employee does not complete his/her duty, despite summons, he or she can be fined. It should be noted that an employer who does not comply with the regulations may be subject to proceedings for tax evasion or tax misappropriation, whether the responsible individuals have acted intentionally or negligently. In case of errors in the calculation, the employer can make the necessary corrections himself until March 31 of the following fiscal year.

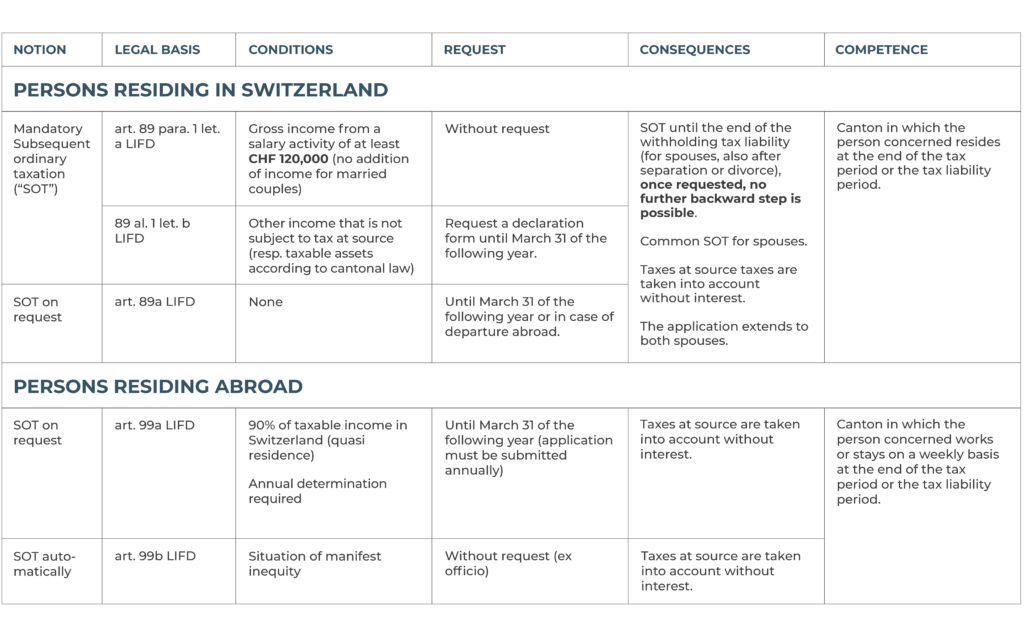

Thirdly, workers taxed at source can no longer claim their additional deductions by way of a claim. From now on, these deductions can only be made through a Subsequent Ordinary Taxation (“SOT”). It may be interesting to use the SOT to claim additional deductions such as purchases of occupational pension plans, payments to the 3rd pillar “A” or other deductions that are not included in the simplified rates which apply for the tax at source. Depending on the employee’s situation, the establishment of the SOT may be compulsory, made on request or ordered ex officio (by the tax authorities). Below you will find a summary table of the SOT:

The changes related to the taxes at source imply other changes. We have chosen to highlight the changes in territorial jurisdiction, the increased duty of the employer to establish the personal situation of the worker and the changes relating to the Subsequent Ordinary Taxation.

If you have any questions regarding your particular tax situation, either as an employer at source or as a worker subject to this tax, we would be happy to answer them in order to optimize your tax situation or simply to correctly meet the legal requirements.