On 13 October 2021, the State Council of the Canton of Vaud adopted several important measures to enable the Canton to remain competitive, in particular with regard i) to the valuation of securities that are unlisted on the stock exchange for wealth tax purposes and ii) to the taxation of capital benefits arising from pension funds for income tax purposes. The following is a detailed description of these measures, including examples to show the impact that these measures will have in the future.

For shareholders who hold their own company based in the canton of Vaud, the valuation of shares will be more conservative in order to consider the entrepreneurial risks, by adapting the method that the administration usually applies to all valuations of unlisted securities.

Capital benefits from pension funds, in particular those paid out by pension funds at the time of retirement, were taxed more heavily than in most Swiss cantons. From now on, these benefits will be taxed in the same way as for the federal tax, i.e. at 1/5 of the ordinary rate.

Tax reduction in the canton of Vaud: four measures expected in 2022

Four measures to reduce the tax burden on individuals have been adopted by the State Council of the Canton of Vaud. These measures concern both income tax and wealth tax. The State Council of the Canton of Vaud will vote on these various measures in December. Once the law and the decrees have been published, a 65-day referendum period will begin.

1. Valuation of securities that are unlisted on the stock exchange – “Work tool”

The market value is decisive for wealth tax purposes. Such a value does not exist for the shares of a company that is not listed on the stock exchange (e.g. shares of an SME). The so-called practitioners’ method is applied by the tax authorities to value these securities.

This valuation corresponds to the average obtained by weighting i) twice the capitalised yield value and ii) once the value of substance. The yield value, which corresponds to the net profits of the relevant business years, is capitalised using a rate published in Circular 28 of the Swiss Tax Conference, dated 28 August 2008, or in its comments published each year. This rate was 7% until 31.12.2020 and 8.2355% in 2021.

In order to allow a taxpayer, who is both shareholder and employee of his company (“work tool”), to pay the wealth tax levied on the value of his shares, a distribution of the company’s reserves (equity) may be inevitable. In a context of health crisis, companies must be able to preserve their equity in order to face current and future economic difficulties. By working on the capitalisation rate applied to the yield value of the company, it is possible to reduce the wealth tax consequences. As the following example shows, the lower the capitalisation rate, the higher the value of the securities and the higher the wealth tax. Conversely, the higher the capitalisation rate, the lower the value of the securities and the lower the wealth tax. In the explanatory statement of the State Council of the Canton of Vaud, a comparison is made using a fairly high capitalisation rate of 16%.

Example: Assuming that an entrepreneur’s company (“work tool”) achieves an average return value of CHF 450,000 and has equity of CHF 700,000, this would result in a valuation difference of around

CHF 1,768,000, as shown below:

Considering a maximum wealth tax rate of 0.8%, the wealth tax saving in the above example is estimated at approximately CHF 14,000. This tax saving is justified by the increase in the capitalisation rate alone.

The topical legal provisions of the Vaud Cantonal Law will be amended accordingly and will henceforth stipulate that “The value of unlisted securities and securities not regularly listed on the stock exchange shall be subject to an estimate; the State Council shall adopt the implementing provisions”. The modalities relating to the “work tool”, respectively the capitalisation rate (revised upwards) will therefore be laid down in an ad hoc regulation.

2. Capital benefits arising from pension funds – Tax relief

Capital benefits arising from pension funds are subject to income tax.

However, this is a separate taxation than other income, in application of a special scale which is equivalent, in the canton of Vaud, to 1/3 of the basic scale applicable to other ordinary income. By way of comparison, for both direct federal tax (“IFD”) and cantonal and communal tax (“ICC”) in most other cantons, the rate applicable to capital benefits from pension funds is equivalent to 1/5th of the basic scale. Based on this observation, it was necessary for the canton of Vaud to harmonise its legal provisions with those applicable to the IFD and in most other cantons. This is not a genuine concession to taxpayers, but rather an adaptation that tends to remove a welcome disparity in treatment. By way of illustration, we have made an intercantonal comparison of the tax burden in the area of pension funds ( Appendix )

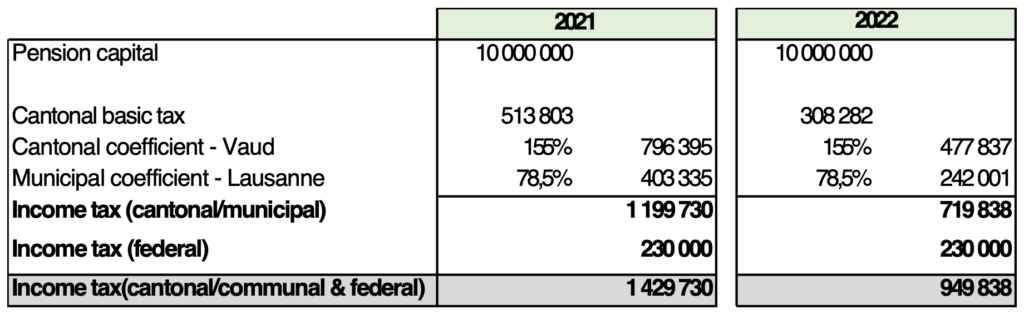

For example, a single taxpayer residing in Lausanne who withdraws a capital sum from a pension fund will be taxed as follows in 2021, respectively in 2022:

The result is a significant tax saving of approximately CHF 480,000. This tax saving is justified by the mere adaptation of the tax scale for pension capital to the scale applied at federal level and in the majority of other cantons for many years now.

3. Deductions for childcare costs

As of 1 January 2022, the deduction for childcare costs will be increased by CHF 1,000, so that the maximum deduction per child in the canton of Vaud will be CHF 10,100. This is already the case for the “IFD”. However, the following conditions must still be met:

- Third party custody;

- Child under 14 years of age;

- Joint household with the supporting parent; and

- Direct causal link between the documented childcare costs and the parent’s gainful activity, education or earning incapacity.

4. Low-income taxpayer deduction

From 1 January 2022, the deduction for low-income taxpayers will be increased by CHF 200 to CHF 16,000 for taxpayers whose net income does not exceed CHF 16,099.